Unknown Facts About Tulsa Bankruptcy Lawyers

Unknown Facts About Tulsa Bankruptcy Lawyers

Blog Article

When money worries pile up, and it appears like you happen to be sinking deeper into debt, it’s simple to feel like there isn't any way out. But maintain on, mainly because There's hope. Individual bankruptcy can appear to be a scary term, but Actually, it can be a lifeline. If you're in Tulsa and combating overpowering personal debt, then Tulsa personal bankruptcy legal professionals are your go-to allies. They concentrate on guiding you in the murky waters of personal bankruptcy, encouraging you navigate the intricate legal landscape to search out aid and, most of all, a clean start.

So, why need to you concentrate on reaching out to your Tulsa individual bankruptcy lawyer? Permit’s be serious—managing credit card debt can be baffling and overwhelming. The legal jargon by yourself will make your head spin. That’s exactly where these authorized professionals are available. They break down the law into bite-sized, comprehensible pieces, so you can make knowledgeable selections regarding your financial long term. Whether or not It truly is Chapter seven or Chapter thirteen, Tulsa individual bankruptcy lawyers will walk you through the options, aiding you fully grasp which route is most effective fitted to your one of a kind situation.

How Tulsa Bankruptcy Lawyers can Save You Time, Stress, and Money.

You will be contemplating, "Do I really need an attorney? Can’t I just file for bankruptcy myself?" Guaranteed, you may try to deal with it on your own, but it surely’s like wanting to take care of a broken motor vehicle with no knowing what’s beneath the hood. Bankruptcy rules are complex, and just one wrong transfer can set you back large time. A Tulsa individual bankruptcy lawyer is aware the ins and outs of such legal guidelines and will let you steer clear of prevalent pitfalls that could derail your situation. They’re similar to the mechanics of the legal entire world, great-tuning your case so you will get the absolute best consequence.

You will be contemplating, "Do I really need an attorney? Can’t I just file for bankruptcy myself?" Guaranteed, you may try to deal with it on your own, but it surely’s like wanting to take care of a broken motor vehicle with no knowing what’s beneath the hood. Bankruptcy rules are complex, and just one wrong transfer can set you back large time. A Tulsa individual bankruptcy lawyer is aware the ins and outs of such legal guidelines and will let you steer clear of prevalent pitfalls that could derail your situation. They’re similar to the mechanics of the legal entire world, great-tuning your case so you will get the absolute best consequence.Among the crucial roles of the Tulsa individual bankruptcy law firm is to shield your assets. Filing for bankruptcy will not automatically signify you’ll lose every thing you very own. With the best authorized steerage, you can often keep your home, vehicle, and personal belongings. Tulsa bankruptcy legal professionals know the exemptions and protections that can be placed on your circumstance, making sure that you choose to continue to keep just as much within your residence as feasible when finding rid with the credit card debt that’s weighing you down.

Allow’s speak about tension. Debt can be a large supply of pressure, impacting every thing from your health towards your associations. The consistent calls from creditors, the looming danger of foreclosure, plus the dread of wage garnishments—it’s adequate to keep you up during the night time. But if you retain the services of a Tulsa bankruptcy attorney, they get that burden off your shoulders. They cope with the negotiations with creditors, the paperwork, as well as the court docket appearances. You have to breathe a bit a lot easier being aware of that a professional is as part of your corner, combating for your personal fiscal freedom.

Now, you would possibly question, "How can I choose the suitable Tulsa bankruptcy attorney?" It’s a good concern. Not all legal professionals are developed equivalent. You’ll want somebody with practical experience, a confirmed history, and, most importantly, somebody that would make you feel cozy. Bankruptcy is a personal make a difference, and You'll need a law firm who listens, understands, and truly would like to assist you. Don’t be afraid to buy around. Fulfill which has a couple lawyers, talk to inquiries, and have confidence in your intestine. The best law firm could make all the real difference.

Submitting for personal bankruptcy is a giant decision, and it’s not a single to get taken flippantly. It’s crucial to realize that personal bankruptcy isn’t a magic wand that could right away solve all your issues. It’s a lot more just like a reset button. Indeed, it could possibly wipe out sure debts and offer you a fresh new start, but Additionally, it comes with implications, such as a hit to your credit rating. That’s why aquiring a Tulsa bankruptcy law firm by your aspect is critical. They assist you weigh the pros and cons, so you know exactly what you’re stepping into prior to deciding to take the plunge.

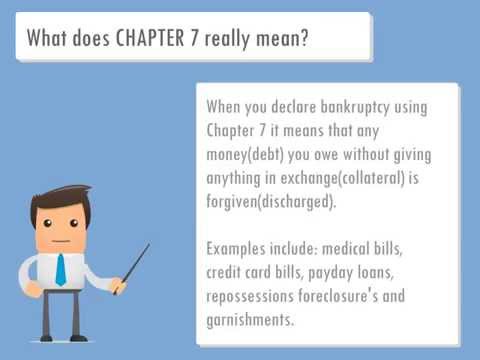

Just about the most typical kinds of individual bankruptcy is Chapter seven, often known as liquidation bankruptcy. It’s designed for people who may have small to no disposable income. For those who qualify, a Tulsa personal bankruptcy lawyer can guideline you thru the process of liquidating your non-exempt belongings to repay your creditors. It might seem harsh, but it’s generally the quickest way to eliminate mind-boggling debt and begin refreshing. The better part? You might be debt-absolutely free in only a few months, supplying you with the economic liberty to rebuild your lifetime.

Over the flip side, there’s Chapter thirteen bankruptcy, and that is frequently often called a reorganization bankruptcy. In case you have a gentle revenue but are battling to keep up using your payments, Chapter thirteen could be an even better choice. A Tulsa personal bankruptcy law firm can help you develop a repayment approach that works to suit your needs, allowing for you to pay off your debts in excess of a duration of a few to five years. The reward? You can get to keep your assets although catching up on skipped payments. It’s like hitting the pause button on the financial anxiety, providing you with time and energy to get again on track.

Now, let’s get actual for any minute. Personal bankruptcy is frequently found as A final vacation resort, a remaining option when there’s no other way out. But that doesn’t imply it’s one thing for being ashamed of. Daily life transpires. Probably you missing your career, obtained strike with unpredicted clinical costs, or went via a divorce. These items can come about to any individual, and often, personal bankruptcy is the sole method of getting a thoroughly clean slate. Tulsa bankruptcy legal professionals have an understanding of this. They’re not in this article to evaluate you; they’re listed here that can assist you discover a way forward.

A further detail to take into consideration could be the effect of bankruptcy on the long run. It’s real that bankruptcy stays on the credit rating report for seven to 10 a long time, according to the type of individual bankruptcy you file. But listed here’s the silver lining—many people who file for individual bankruptcy already have weakened credit rating. The good news? Submitting for bankruptcy can in fact be the first step towards rebuilding your credit. With the assistance of a Tulsa personal bankruptcy lawyer, you can start having methods to enhance your credit history score suitable following your individual bankruptcy is discharged.

You may be wanting to know about the cost of choosing a Tulsa bankruptcy attorney. It’s a sound concern, particularly when you’re now managing money issues. But listed here’s the detail—several personal bankruptcy legal professionals provide cost-free consultations, they usually frequently work on a flat cost foundation. This means you’ll know what exactly you’re shelling out upfront, with no hidden fees. Imagine it being an investment within your fiscal long run. The peace of mind that comes with understanding you've got a skilled Qualified managing your circumstance is worth each penny.

Getting The Tulsa Bankruptcy Lawyers To Work

With regards to timing, it’s by no means as well early to refer to which has a Tulsa individual bankruptcy attorney. Even if you’re just beginning to slide driving in your expenses, an attorney may help you check out your options. Individual bankruptcy may not be required immediately, but owning an attorney within your corner early on can help you stay clear of generating pricey issues. They will advise you regarding how to manage creditors, what steps to acquire to guard your belongings, and when it would be time to consider personal bankruptcy as a solution.When you’re worried about the stigma of personal bankruptcy, know that you’re not by yourself. Lots of people sense embarrassed or ashamed about submitting for bankruptcy, nonetheless it’s important to bear in mind bankruptcy rules exist for just a cause. They’re meant to give individuals a 2nd prospect, a way to get back again on their own feet right after money hardship. Tulsa bankruptcy attorneys have viewed it all, and so they’re listed here to show you that there’s no shame in searching for support. In actual fact, it’s among the bravest stuff you can do.

Personal bankruptcy isn’t pretty much wiping out personal debt—it’s about creating a far better foreseeable future. By doing away with the financial burden that’s been holding you back, you can start concentrating on the things that genuinely subject, like All your family members, your vocation, plus your health. A Tulsa bankruptcy lawyer can explore more help you put a discover here strategy in place for moving forward, so you can begin dwelling the everyday living you have earned. They’ll help you established real looking aims, rebuild your credit rating, and develop a funds that works for you personally.

Should you’re nonetheless around the fence about contacting a Tulsa bankruptcy law firm, look at this: what do You will need to drop? In the very the very least, a consultation will provide you with a better idea of your options and what to expect if you choose to transfer forward with individual bankruptcy. Information is energy, and the greater you recognize, the better Geared up you’ll be to produce the proper conclusion on your financial long run. Bear in mind, you don’t have to endure this alone—assistance is just a cell phone contact absent.

As you weigh your choices, keep in mind that personal bankruptcy is not a one particular-size-matches-all Alternative. What operates for a person individual may not be the best choice for an additional. That’s why it’s so imperative that you explore more Possess a Tulsa personal bankruptcy law firm who can tailor their tips towards your particular condition. They’ll take the time to acquire to be aware of you, understand your targets, and acquire a technique that’s customized to your requirements. No matter if you’re facing foreclosure, wage garnishment, or simply a mountain of bank card credit card debt, a Tulsa personal bankruptcy law firm will let you find the light at the end of the tunnel.